The financial services industry is undergoing a fundamental transformation – driven not by traditional banking institutions, but by the rapid rise of fintech innovation. At the core of this shift are two converging forces: Artificial Intelligence (AI) and Cloud Computing.

Together, AI and cloud technologies are enabling fintech firms to move faster, think smarter, and deliver highly personalized financial services at scale. From real-time fraud detection and algorithmic credit scoring to automated customer support and intelligent investment recommendations – AI is redefining how financial decisions are made. Meanwhile, the cloud provides the infrastructure to deploy these solutions globally, securely, and with agility.

This blog explores how the intersection of cloud and AI is unlocking the next wave of innovation in fintech – improving operational efficiency, enhancing risk management, and enabling seamless user experiences that were once unimaginable.

The Convergence of AI and Cloud in Fintech

While AI and cloud computing have individually transformed industries, their combined impact on fintech is particularly disruptive – and deeply strategic.

Cloud computing offers the backbone: flexible infrastructure, scalable storage, and global reach. It eliminates the need for on-premise systems, allowing fintechs to launch, test, and scale products faster. Whether it’s a mobile wallet, lending platform, or wealth management app, cloud-native services reduce time-to-market and enable real-time operations.

Artificial Intelligence, on the other hand, brings the intelligence layer – processing vast amounts of structured and unstructured financial data to deliver insights, automation, and personalization. From underwriting decisions to behavioral analytics, AI enables fintech companies to think beyond static rule sets.

But the real power emerges when these two technologies work together.

Running AI models in the cloud allows fintechs to:

- Access high-performance computing without major upfront costs

- Deploy real-time analytics and recommendation engines

- Seamlessly update and scale models based on user data

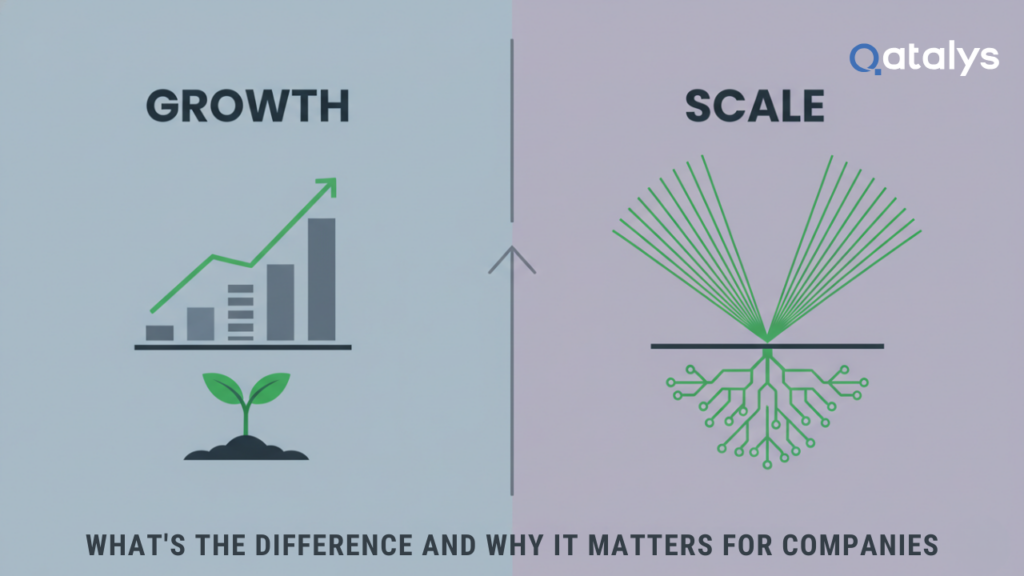

This synergy is what’s powering the next generation of financial services – adaptive, data-driven, and built for scale.

Key Innovations Enabled by AI and Cloud

The combination of cloud infrastructure and artificial intelligence is not just an upgrade – it’s a catalyst for innovation across every layer of the fintech value chain. Below are some of the most impactful use cases reshaping the industry:

1. Personalized Financial Services

AI models trained on user behavior and transaction history can deliver hyper-personalized experiences – like tailored loan offers, dynamic credit limits, or customized investment strategies. Cloud environments allow these models to continuously improve with fresh data, without disrupting performance or compliance.

2. Smarter Fraud Detection

Traditional rule-based fraud systems are giving way to AI-driven models that detect anomalies in real time. These systems learn and evolve as fraud tactics change. When deployed in the cloud, they can scan millions of transactions per second – helping fintech companies identify threats before damage occurs.

3. Real-Time Credit Scoring

Alternative credit scoring models, powered by AI, analyze non-traditional data such as mobile phone usage, utility payments, and even social signals. With cloud infrastructure, this data can be processed at speed and scale, enabling faster lending decisions – especially for underbanked populations.

4. Enhanced Customer Support

AI-powered chatbots and virtual assistants are now standard in fintech apps, handling everything from account queries to financial planning tips. Hosting these systems in the cloud ensures 24/7 availability, multilingual support, and seamless integration with customer data platforms.

5. Intelligent Automation and Efficiency

Back-office processes – like KYC verification, claims processing, or reconciliation – can be automated using AI and deployed on cloud platforms. This not only reduces operational costs but also improves accuracy and speed, allowing teams to focus on high-value work.

Practical Applications Across the Fintech Landscape

The impact of AI and cloud technologies isn’t theoretical – it’s already shaping real products and platforms in the global fintech ecosystem. Here’s how different sectors are using this convergence to solve real-world problems:

Neobanks and Digital-Only Banks

Cloud-native by design, neobanks use AI to deliver seamless, personalized banking experiences via mobile apps. From instant account verification to real-time budget insights, these institutions rely on cloud scalability to support millions of users while using AI to deliver smarter, faster interactions.

Insurtech Platforms

AI is revolutionizing the insurance sector by automating claims assessment, detecting fraudulent activity, and underwriting policies based on behavior rather than broad risk categories. With cloud-based systems, these services can be deployed quickly and adapted to regional regulatory environments.

WealthTech and Robo-Advisors

AI-driven portfolio management tools analyze user risk profiles, market conditions, and spending behavior to deliver optimized investment strategies. The cloud supports these applications with dynamic data feeds, rapid model iteration, and secure, compliant infrastructure.

Embedded Finance and Open Banking

Thanks to cloud-hosted APIs and AI-powered data analysis, fintech companies can embed financial services into non-financial platforms – like offering lending within an ecommerce site or budgeting tools in a wellness app. AI refines the user experience, while the cloud ensures reliability and scale.

These examples reflect a broader truth: fintechs that embrace both cloud and AI are not just keeping up – they’re setting the pace.

Challenges and Considerations

While the fusion of AI and cloud technologies offers massive upside, it also presents a set of real-world challenges that fintech companies must address head-on.

1. Data Privacy and Security

Handling sensitive financial data – such as personal identifiers, transaction logs, and behavioral patterns – comes with strict regulatory expectations. Hosting this data in the cloud requires robust encryption, access controls, and continuous monitoring. Fintechs must ensure that their cloud vendors meet regional compliance standards (e.g., GDPR, PCI-DSS, SOC 2).

2. Regulatory Complexity

AI-based decision-making – especially in areas like lending, insurance, or investing – can raise red flags if the logic behind those decisions isn’t transparent. Fintechs must build explainable AI (XAI) systems and ensure model outputs can be audited. Simultaneously, using cloud services across multiple jurisdictions introduces further compliance variables.

3. Integration with Legacy Systems

Established financial institutions exploring cloud and AI must contend with legacy infrastructure. Integrating AI modules with outdated core banking systems or moving data from on-premise to cloud environments can be time-consuming, expensive, and risk-prone – especially without a phased modernization strategy.

4. Talent and Execution Gaps

Successfully deploying AI and cloud solutions requires a blend of data scientists, DevOps engineers, and compliance experts – a combination that many fintech startups or traditional financial firms struggle to assemble internally. Partnering with specialists or managed service providers can help bridge the gap.

Despite these challenges, the long-term value of getting AI and cloud right far outweighs the early hurdles. What’s needed is a strategic, well-governed approach.

Future Outlook

As the financial services industry evolves, the convergence of AI and cloud computing will continue to be a defining factor in how fintechs differentiate, scale, and serve customers.

1. Generative AI and Advanced ML Models

Beyond traditional machine learning, fintechs are beginning to explore generative AI for automating complex workflows – like document analysis, report generation, or even compliance documentation. These models, trained and deployed in the cloud, will reshape operational speed and personalization levels.

2. AI-Powered Decision Infrastructure

In the future, we’ll see more decisioning systems built entirely on AI models – handling everything from credit approvals to product recommendations in real-time. These systems will be hosted in cloud-native environments, enabling continuous training and optimization with fresh data streams.

3. Multi-Cloud and Industry-Specific Clouds

To address regulatory complexity and enhance resiliency, many fintechs are moving toward multi-cloud strategies or adopting financial services-specific cloud solutions. This allows greater control over data locality, redundancy, and specialized compliance configurations.

4. Embedded AI in Every Layer

AI will no longer be limited to just user-facing features. It will be embedded into infrastructure, security protocols, fraud engines, and even software development workflows – creating a truly intelligent fintech stack.

5. More Collaborative Ecosystems

Open banking frameworks and cloud-hosted APIs will foster deeper collaboration between fintechs, traditional banks, and third-party service providers. AI will act as the connective tissue – analyzing data, predicting trends, and orchestrating customer experiences across platforms.

The fintechs that stay ahead will be those that view AI and cloud not as isolated technologies, but as a unified engine for continuous innovation.

Conclusion

The fusion of AI and cloud computing is more than a trend – it’s the foundation of the fintech industry’s next chapter. Together, these technologies are enabling smarter decision-making, faster innovation, and more meaningful user experiences across the financial ecosystem.

From personalized products and automated risk assessments to real-time fraud detection and seamless digital experiences – AI and cloud are setting new standards for agility, scale, and intelligence in financial services.

For fintechs and financial institutions alike, the question is no longer if they should embrace these tools, but how fast they can do it – safely, strategically, and sustainably.

How Qatalys Can Help

At Qatalys, we help fintech innovators build and scale smarter with AI-powered architectures and cloud-native engineering. Whether you’re modernizing a legacy product, launching a new digital service, or embedding intelligence into your financial stack – we bring deep tech expertise, agile delivery, and domain-aligned execution to every engagement.

Ready to future-proof your fintech offering? Let’s talk.