Discover Lean, Scalable Market Validation Tactics for Startups

Startup founders face a familiar fear: building something nobody wants. When funds are tight and pressure runs high, every test, pitch, and customer conversation counts. Yet, too many B2B ventures waste precious resources pursuing unproven ideas, only to hit a dead end after investing months of effort.

What if you could validate demand fast. Without a sprawling budget?

This guide surfaces the most practical, proven tactics for B2B market validation in 2025. You’ll learn:

- Low-cost validation strategies that work for real decision-makers

- How to collect early buying signals and avoid false positives

- Which modern tools streamline the testing process

- Why the right evidence wins over investors and fuels smarter growth

Whether you’re pre-seed or ramping up for your first round, let’s dissect what separates scrappy validation from wasted spend.

Budget-Friendly B2B Validation Tactics That Work

There’s a reason advice like “just get out there and talk to customers” lives on year after year. Conversation is cheap. And it’s often where the truth reveals itself. But real traction goes beyond polite feedback. Here’s how lean B2B teams are getting to the truth, fast:

1. Pre-Sales: Ask for Commitment, Not Just Feedback

Nothing validates a B2B hypothesis better than a decision-maker’s willingness to pay. Pre-sales involves pitching your solution. Sometimes as little as a concept and a landing page. And asking prospects for LOIs (letters of intent), deposits, or even early invoices. Those early agreements are gold: they separate casual interest from real urgency.

2. Concierge MVPs: Solve the Problem by Hand

The minimum viable product development still dominates, but “concierge” MVPs take it a step further. Here, you deliver your solution manually, minus automation. One founder I advised built an “AI-powered” reporting tool for CFOs. But delivered insights through custom spreadsheets and consulting calls for their first few paying clients. The lessons learned? Priceless.

3. Problem-Focused Landing Pages

An idea landing page, paired with a clear value proposition and a way for visitors to signal interest (demo bookings, waitlists, or test pilots), can reveal which pain points resonate. The magic isn’t in how many visit. It’s in how many opt in, and what kind of decision-makers respond. Smart founders A/B test messaging or run paid ads for niche segments to quickly gauge demand.

Early Buyer Intent: Collect Signals That Matter

Getting your first ‘yes’ from a potential customer feels like a big victory. But in the B2B world, not all buying signals are equal. You’re not looking for applause. You need real intent from real decision-makers. How do founders separate genuine interest from noise?

- Track Action, Not Just Words: Did they book a demo, share a budget, or refer you to procurement? Passive agreement (“This sounds great…”) often leads nowhere. Instead, count hard actions. Signed LOIs, requests for pricing, or a commitment to pilot your prototype.

- Watch for Buying Group Engagement: B2B deals often involve more than one stakeholder. If your landing page or outreach attracts multiple roles from the same company, you’re onto something.

- Use Modern Intent Data Platforms: In 2025, intent data collection has matured. Platforms now aggregate signals from website visits, content downloads, and search activity to build clear pictures of who is truly in-market. Specialized B2B analytics dashboards can reveal if CIOs, CFOs, or other critical decision-makers are actually engaging with your proposition.

R

Interpreting Signals Without Fooling Yourself

False positives are everywhere. Clicking “learn more” isn’t buyer intent. What counts: repeated engagement, resources spent (like time or money), and any form of real commitment. Experienced B2B sellers now filter out the noise by building structured validation funnels. Moving prospects from low-barrier interest (webinar sign-ups) to high-barrier actions (test agreements or payment details).

Common Pitfalls: How to Dodge Vanity Metrics & Bias

Plenty of founders get trapped by the wrong signals during market validation. It’s easier than you think to read too much into a handful of positive responses, a bump of web traffic, or vague interest from non-decision-makers. Understanding common startup mistakes can help you avoid these validation traps:

- Vanity Metrics: Beware of celebrating page visits, email signups, or “likes” as indicators of real demand. These numbers can make you feel good, but they rarely map to true buying intent. Real validation always comes from actions connected to a business’s core pain point. And budget.

- False Positives: Sometimes, friends, peers, or industry acquaintances want to be supportive. They say, “That’s a brilliant idea!” but have no real stake. Prioritize conversations with buyers who have a problem to solve, authority to spend, and urgency to act.

- Sample Bias: If your interviews or outreach only target people in your network or a narrow segment, you risk missing broader signals. Always cast a wider net. Use cold outreach, targeted ads, and industry events to reach outside your comfort zone.

A Founder’s Lesson

I once coached a B2B SaaS team that celebrated a list of 100 early signups. Nearly all from tech meetups and their own LinkedIn followers. Only when they started emailing fresh, unfamiliar prospects did they uncover a far frostier reality. And pivoted fast. Honest data beats ego, every time.

Tools & Platforms: B2B Testing, 2025 Edition

Advances in digital tools now make it easier to validate at scale, letting you run lean experiments and track signals without guesswork. Here’s what’s proving effective for B2B startups right now:

AI-Powered Survey & Discovery Tools

New platforms like NewtonX verify B2B participants and analyze interview data in-depth, reducing the risk of biased responses. For rapid survey distribution, AI-powered solutions can segment by industry, seniority, and intent.

Intent Data Platforms

Services such as Demandbase and LeadLander now let you track web visits, company research activity, and third-party review signals. All key to identifying buyers early. These tools filter for real purchase signals instead of generic interest, shining a light on in-market accounts.

A/B & Message Testing Solutions

A/B testing suites, from CausalFunnel to more classic offerings like VWO, empower you to refine messaging and probe for resonance long before a major release. Many integrate with CRM and analytics platforms for seamless insight.

Landing Page Builders

Niche-focused landing page builders with B2B templates, scoring, and even video outreach integrations support validation with less manual work. A quick, high-conversion page can be built and tested in hours. Letting you iterate faster and more frequently.

Building Investor Confidence With Real Validation

One distinction stands out: the startups that raise, grow, and survive are those that bring hard evidence to the table. Investors in 2025, especially at the seed stage, demand more than a good story. They look for demonstrated demand and clear traction. Even if your product is still rough around the edges. Avoiding common fundraising mistakes starts with solid validation data.

Validated insights show:

- Your team knows how to learn and adapt faster than the market shifts.

- There’s unmistakable proof that decision-makers will take action (not just offer encouragement).

- You can articulate ROI or business value from day one. Even with a tiny user base.

Seed investors gravitate toward founders who treat validation as an experiment, not a box to check. This builds trust and makes future growth milestones more predictable. At Qatalys, our experience helping founders structure validation sprints repeatedly reveals that systematic, documented proof of concept arms you for investor conversations. It sharpens your pitch and boosts the odds of meaningful partnerships later on.

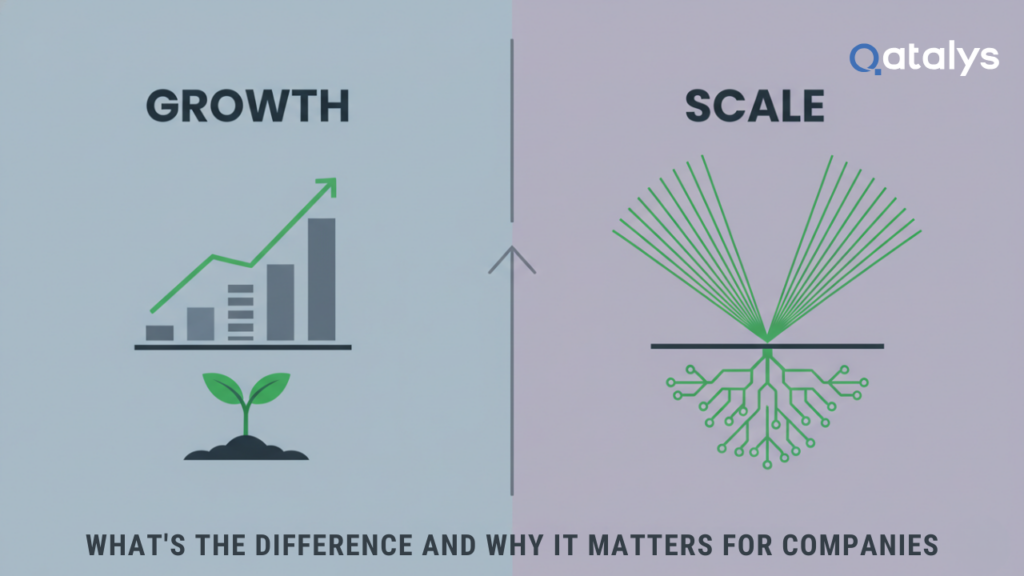

Why Smart Market Validation Drives Growth

Lean validation matters far beyond fundraising. Founders who test principles early avoid the sunk cost trap, shorten sales cycles, and adapt to unexpected findings (instead of doubling down on assumptions). Your tactics today set the stage for scalable, resilient growth tomorrow.

Qatalys: Your Partner for Digital Innovation

At Qatalys, we empower startups and enterprises to move from hypothesis to market-fit through strategic testing, modern tools, and global expertise. Our mission: help you convert early insights into confident decision-making, operational excellence, and outsized impact. From AI-driven market analysis to scaling product teams in Global Capability Centers, we accelerate your journey.

Need expert support to take your validated idea to market? Discover how Qatalys Venture Studio accelerates startup growth.

Frequently Asked Questions

What’s the difference between validation and market research?

Market research is broad and can cover many forms of learning. Competitive analysis, customer discovery, general trends. Validation is about proving that real, paying decision-makers experience the problem, recognize your value, and will commit in concrete ways.

How long should B2B market validation take?

Scrappy teams can unlock meaningful answers in weeks, not months. Fast cycles, focused experiments, and clear signoff from decision-makers keep you moving forward.

Which metrics matter most for “proof of demand”?

Lawful sales signals. Signed LOIs, paid pilots, or clear commitments to implement. Beat soft metrics every time. Track engagement from real buyers, not just prospects.

Do I need a complete product to validate my B2B solution?

No. Early testing can happen with slides, video demos, or hands-on concierge service. It’s about the commitment, not the polish.

How does Qatalys help with B2B validation?

Qatalys brings expertise, modern frameworks, and digital tools to guide founders from idea to traction. We help structure experiments, interpret buyer signals, and drive forward with confidence. So you build products that matter.