If you’re building your first startup, one of the biggest early questions you’ll face is: “How do I fund this?”

The default thinking often comes down to two extremes: Bootstrap it solo, or raise money from VCs or angels.

But the truth is more nuanced. Each path has different implications—on your speed, ownership, control, and even product quality.

And there’s a third model that’s gaining ground among early-stage founders: the venture studio. Somewhere between bootstrapping and VC, it offers a blend of capital, in-house product execution, and growth support—while still keeping founders in the driver’s seat.

In this guide, we’ll break down the three funding paths most relevant to first-time founders:

- Bootstrapping

- Venture Capital / Angel Investment

- Venture Studio Partnership

We’ll walk through the pros, cons, tradeoffs—and help you figure out which path aligns best with your goals and risk appetite.

1. Bootstrapping – Full Control, Full Risk

Bootstrapping means building your startup without raising external funding—using personal savings, early revenue, or side income to support the business. It’s a path that many first-time founders gravitate toward, especially those who want to retain full ownership and avoid outside pressure.

Why founders choose it:

- You call all the shots—no investor boards, no external expectations

- Every decision is guided by customers, not funding rounds

- Profitability becomes a priority from day one

Advantages:

- 100% ownership: No equity dilution or investor control

- Focus on fundamentals: Forces clarity on customer needs, revenue, and cost control

- Freedom to pivot: No pressure to scale before you’re ready

Tradeoffs:

- Limited runway: You’re funding the business out of pocket

- Slower growth: Without capital, hiring, marketing, and R&D are harder

- Founder burnout risk: Wearing too many hats for too long takes a toll

Best for:

- Founders with strong domain knowledge and execution ability

- Capital-light business models (e.g. consulting, SaaS with simple MVPs)

- Teams that can validate, build, and grow without hiring full-time staff

Bootstrapping gives you total independence—but it also demands discipline, sacrifice, and resilience. It’s a test of both product-market fit and personal endurance.

2. VC & Angels – Speed and Capital, With Strings Attached

Venture Capital (VC) and angel investment are often seen as the holy grail of startup funding—especially in tech circles. They provide the capital to move fast, hire early, and make bold bets. But they come with a very specific playbook.

You’re not just taking money—you’re taking on expectations for rapid growth, follow-on rounds, and eventually, a big exit.

Why founders choose it:

- You need capital to build fast, capture market share, or invest in R&D

- You want experienced investors who can open doors and offer strategic support

- You’re building a company that aligns with the high-growth, venture-scale model

Advantages:

- Significant upfront capital: Fund product development, team building, and GTM

- Credibility: VC backing can attract talent, press, and future investors

- Network: Good VCs bring mentorship, partnerships, and fundraising guidance

Tradeoffs:

- Equity dilution: Founders often give up 15–30% per round

- Loss of control: Investor boards may influence decisions or push for exits

- Pressure to grow fast: Not all businesses are built for the VC timeline

Best for:

- High-growth businesses targeting large markets

- Experienced teams with a validated MVP and early traction

- Founders willing to trade equity for speed and scale

VC isn’t bad—but it’s not for everyone. Many first-time founders underestimate the intensity of the venture path. Before raising, be clear whether you’re chasing hypergrowth or building for sustainability.

3. Venture Studio – Capital + Execution, Shared Risk

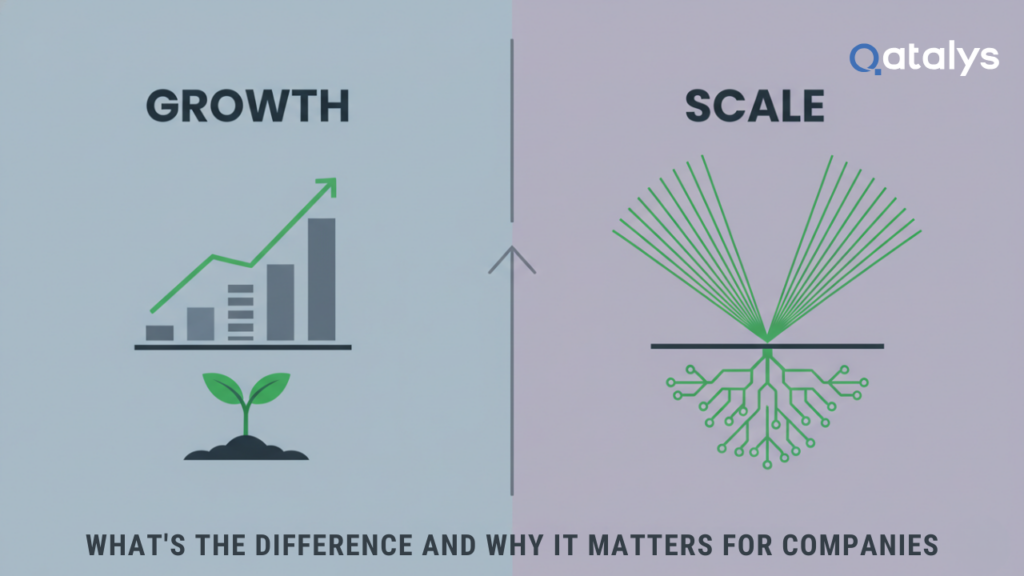

The venture studio model is different. It’s not just funding—and it’s not just a dev agency. It’s a hybrid: you get capital and a ready-to-go product, design, and GTM team, all embedded and aligned with your growth.

Think of it as a co-building partner, not just an investor.

You bring the vision, validation, and early traction. The studio brings resources, execution horsepower, and shared skin in the game.

Why founders choose it:

- You’ve validated the problem, maybe even built an MVP—but lack execution bandwidth

- You need a team to build and grow, but aren’t ready to hire full-time

- You want strategic input and hands-on support

Advantages:

- Funding + execution in one: Get capital and a full-stack build team from day one

- Faster time to market: Skip the 3–6 months it takes to hire, onboard, and manage

- Shared risk: The studio’s upside depends on your startup’s success

- Cross-functional expertise: From product and tech to GTM, growth, and fundraising

Tradeoffs:

- Equity involvement: Like VC, the studio takes a stake in exchange for services + support

- Not for idea-stage founders: Studios typically want traction or initial funding in place

- Requires high founder engagement: This is co-building, not delegation

Best for:

- Non-technical founders with early validation or funding

- Teams that need to launch fast but don’t have in-house capabilities

- Startups that want a strategic partner across product, growth, and funding—not just capital

Venture studios aren’t as well-known as VCs or accelerators—but they’re rapidly becoming a go-to option for execution-minded founders who value speed, support, and alignment.

How to Choose – Founder Fit Questions

There’s no one-size-fits-all answer when it comes to early-stage funding. What works for one founder or business model might break another.

Instead of asking “Which is better?”, ask: “Which model fits where I am—and where I want to go?”

Use these guiding questions to find your path:

Do you want to retain full ownership and control?

- Yes → Bootstrapping

- Somewhat okay with sharing equity → Studio or VC

- Comfortable giving up board control if it brings capital and speed → VC

Do you already have early validation or funding?

- No validation yet → VC or bootstrapping (studios may not engage)

- Have MVP or some traction → Venture studio or VC

- Already profitable or generating revenue → Bootstrapping or studio

Do you have a team in place to execute?

- Yes → Bootstrapping or VC

- No team yet, and you’re non-technical → Venture studio

- Some early hires, need help scaling → Any model

What’s your risk appetite and timeline?

- High ownership, slower pace, less capital risk → Bootstrapping

- Fast scaling, high capital risk, big outcomes → VC

- Balanced: capital + execution with aligned incentives → Venture studio

Where Qatalys Venture Studio Fits In

At Qatalys Venture Studio, we’re not trying to replace VCs or compete with bootstrapping.

We exist to fill the gap in between:

Where early-stage founders need capital, product, and go-to-market execution—but don’t want to spend 6 months fundraising or hiring a full team from scratch.

We work with founders who:

- Have early traction (an MVP, early users, or seed funding)

- Lack technical or GTM bandwidth to move fast

- Want to build a long-term business, not just raise their next round

What We Bring to the Table:

- Flexible Capital: We co-invest with you to extend runway or reduce burn

- Full-Stack Execution Team: Product managers, UI/UX designers, engineers, QA, growth marketers-all in-house

- GTM & Growth Support: From positioning and strategy to actual paid/organic execution

- Aligned Incentives: We win when you do-so we act like co-founders, not vendors

Why Founders Partner With Us:

- You’re done hiring freelancers that slow you down

- You’ve validated the problem-but can’t build alone

- You want someone who’s as committed as you are, not just an investor or service provider

Conclusion

There’s no perfect funding path-only the one that fits your goals, resources, and mindset.

Bootstrapping gives you full control, but demands personal risk and patience.

VC can unlock speed and scale, but comes with pressure and dilution.

Venture studios offer a balanced third option: capital, execution, and a long-term partner.

What matters most is choosing intentionally-with eyes wide open about the trade-offs.

If you’ve got early traction and need both capital and execution support, Qatalys Venture Studio might be the partner to build with you-not just fund you.

Book a Strategy Call

We don’t do mass pitches. We co-build with the right founders. Let’s talk about your product, traction, and whether this model fits.